Introduction

Homeowners facing financial difficulties often find themselves at a critical crossroads: Foreclosure vs Short Sale, which is the better option? The critical nature of mortgage debt demands homeowners need to grasp the consequences of both foreclosure and short sale before making a final decision.

When homeowners must exit the mortgage market through foreclosure or short sale, they encounter completely different financial as well as credit and emotional outcomes. Further in this blog, it explains how to compare different choices along with their effects, as well as presents evidence that showing your home to someone who pays cash makes the most financial sense. The blog presents strategic approaches combined with methods to handle these situations while strengthening financial security for the future.

Understanding Foreclosure: How It Works & Its Consequences

A homeowner’s inability to make mortgage payments allows lenders to start legal foreclosure proceedings that end with the sale of the property. The home selling process in foreclosure typically follows these steps:

- Missed Payments: Repeated payment default triggers the lender to send out a Notice of Default (NOD).

- Pre-Foreclosure Period: Homeowners during the pre-foreclosure period have the potential to pay off their debt while attempting negotiations with lenders to perform short sales.

- Auction Sale: Property sale through auction happens when all attempts to find solutions fail and the property is sold at prices lower than market value.

- Eviction & Credit Damage: After auction failure, the lender becomes property owner, which results in homeowner eviction while their credit score suffers damage.

Consequences of Foreclosure:

- Severe credit damage: The process of foreclosure damages credit score severely by 100 to 160 points and stays visible on reporting systems for seven years.

- Legal implications: The law allows lenders to obtain remaining debt known as deficiency balance after foreclosing on a property.

- Loss of control: When the homeowner has to go through foreclosure, the lender stands as the leader in all decisions, thus restricting the homeowner from making choices about the property’s end sale.

- Difficulty in future home purchases: Multiple mortgage providers tend to avoid granting loans to people with recorded foreclosure activities.

The Short Sale Process for Homeowners: A Viable Alternative?

Short sale is where the homeowner sells the property below the outstanding mortgage value, but with the lender’s permission. The Homeowner’s Short Sale Process is the following:

- Contacting the Lender: The homeowner must prove financial hardship and request short sale authorization.

- Listing the Property: The property is put on sale, typically at market value, with the lender’s consent.

- Negotiation & Offer Approval: Upon receiving an offer, the lender must approve the price and terms of sale.

- Closing the Deal: If approved, the property is sold, and the lender forgives the balance or negotiates a payment schedule.

Advantages of a Short Sale:

- Less impact on credit: Credit scores will typically drop by 50-120 points, and the short sale is on the credit report for four years or less.

- Faster financial recovery: Homeowners can qualify for a new mortgage sooner than they would after a foreclosure.

- More control over the sale: The homeowner actively finds a buyer and negotiates terms.

- Potential debt forgiveness: Most lenders forgive the unpaid balance of the mortgage.

Foreclosure vs. Short Sale: Head-to-Head Comparison

| Factor | Foreclosure | Short Sale |

| Credit Score Impact | Severe (100-160 points lost) | Less severe (50-120 points lost) |

| Time on Credit Report | 7 years | 4 years or less |

| Ability to Buy Again | 5-7 years | 2-4 years |

| Process Complexity | Automatic lender repossession | Requires lender approval |

| Financial Relief | No negotiation, full debt may still be owed | Possible debt forgiveness |

| Control Over Sale | None (lender controls it) | Homeowner negotiates sale |

| Emotional Impact | Stressful, damaging to reputation | Less stigma, more control |

Selling a Home in Foreclosure: Is a Cash Buyer the Best Escape?

If facing foreclosure, selling to a cash buyer can be a smart, fast alternative to either foreclosure or a short sale. Here’s why:

- Quick closing: Cash buyers can finalize the sale in days, preventing foreclosure.

- No lender approval required: Unlike a short sale, cash sales bypass the need for lender approval.

- No repairs or realtor fees: Cash buyers buy houses in as-is condition, making it cheaper and quicker for homeowners.

- Less stress and uncertainty: Homeowners eliminate lengthy negotiations and foreclosure proceeding risk.

- Elite Properties deals in homes in as-is condition, which makes the transaction quick and easy.

Which Is the Better Option for You? A Decision Framework

Short Sale is the Better Option If:

- You prefer to avoid credit damage.

- You can still negotiate with your lender.

- You desire an opportunity to purchase a home again earlier.

- You are willing to undergo the lender-approval process.

Foreclosure is the Only Option If:

- You have depleted all Avoid Foreclosure Options (loan modifications, refinancing, etc.).

- You are unable to sell it or negotiate a short sale in time.

- You are unwilling or unable to pursue the home selling process further.

Selling to a Cash Buyer is the Smartest Move If:

- You need to sell a foreclosure home fast with less stress.

- You don’t want to deal with lender negotiations.

- You want a quick, easy transaction with cash payment assurance.

- Elite Properties provides a hassle-free cash-buying experience, allowing homeowners to avoid foreclosure through an instant sale.

Conclusion: Making an Informed Decision

It is not an easy decision to choose between foreclosure and a short sale, but having the final impacts of each in mind can help the homeowner feel secure in a decision. In most cases, a short sale is a preferable situation for homeowners who want to avoid further hurting their credit while regaining financial health sooner. Yet, under the circumstances that time and solutions are short in supply, foreclosure may be the only way.

With no repairs to perform, no holdups in lender approval, and a quick closing process, Elite Properties provides an easy way to sell an ugly property. Taking proactive measures, seeking professionals, and examining all the possibilities can become the turning point in having a secure future financially.

Ultimately, it will depend on your financial situation and future needs. The important thing is to act early, shop around, and select the option that reduces harm and maximizes recovery and future home ownership opportunities.

Frequently Asked Questions (FAQs)

- What is the primary distinction between a short sale and a foreclosure?

Short sale is a sale by the homeowner with the permission of the lender, while foreclosure is a legal process initiated by the lender after missed mortgage payments. - What is the impact of short sales and foreclosures on credit scores?

Foreclosures cause a more significant drop (100-160 points) and stay on the report for seven years, while short sales cause a smaller drop (50-120 points) and stay on the report for four years. - Can I buy another residence after a short sale or foreclosure?

Yes, but the waiting time is different. A short sale permits a new mortgage in two to four years, whereas foreclosure usually takes five to seven years. - Are short sales and foreclosures taxable?

Yes, forgiven mortgage debt from foreclosures or short sales could be taxable income. Talk to a tax professional. - Can foreclosure be prevented?

Indeed, options are a modification of the loan, refinancing, short selling, or cash sale. The best course may be determined through professional guidance.

Introduction

The home selling process does not necessarily require long commitments or huge levels of stress. Many homeowners dealing with the real estate market in New York City struggle through what amounts to an endless cycle of doubtful conditions and delayed timelines plus hidden expenses. Standard home-selling practices demand lengthy property listings and constant showing activities along with numerous buyer requests that exhaust real estate sellers.

At Elite Properties, a house-buying company, we offer access to a simplified process to sell homes with ease while inheriting total control over your selling timeline. Our team exists to assist homeowners who require urgent house sales or seek an accessible method that eliminates property requirements and open house difficulties.

Our goal is to give homeowners a time-saving and stress-free way to sell their properties which allows them to advance to their future confidently.

Why Selling Your Home Quickly is So Important

If you are wondering “I want to sell my house but how do I do it quickly”. We understand that selling a home quickly is more than just about convenience, it’s often a necessity. Uncertainty about the future can push homeowners to seek urgent solutions. So let’s explore some common situations where time is of the essence:

- Financial Urgency

Life happens. Homeowners face medical crises together with spiraling debts or unplanned financial demands that force them to seek quick solutions for their properties. When dealing with time-sensitive home sales the traditional real estate process often proves unsuitable. A fast home sale creates monetary opportunities by delivering needed financial stability at critical moments. - Job Relocation

An annual total of 35 million Americans relocate for various reasons including job changes. People starting a new job outside of their current city typically lack the time needed to handle home preparation for market listing. Moving forward with your professional transition becomes less stressful when you sell your property quickly through an easy home-selling process. - Avoiding Foreclosure

You face severe mental pressure when dealing with foreclosure as it proves exceptionally complex. Getting into this situation negatively impacts your credit profile so future home buying becomes increasingly difficult. New York residents faced 2,500 foreclosure filing cases during 2023. Quickly selling your home prevents foreclosure so you can protect your future finances and peace of mind. - Saving on Carrying Costs

Owning a home on the market costs you money each month because you have to pay mortgage payments and property taxes along with insurance and basic maintenance bills. Prolonged home ownership creates multiple payments which build up and reduce your financial resources. Elite Properties will give you a swift home sale solution that lets you keep your funds intact when you face ongoing costs.

Why Traditional Methods Aren’t Always Ideal

The standard practices of home selling function appropriately but they don’t suit all potential sellers. Here are a few reasons why:

- Delays in Financing: Bank loans remain crucial for homebuyers yet delays in mortgage financing cause up to 30% of home sales to fall through or stall before completion.

- Costly Repairs and Renovations: Selling your property will require you to spend money on needed upgrades and repairs before attracting potential buyers since these duties can be costly and take plenty of time.

- Uncertain Timelines: In traditional sales transactions you often need to wait multiple weeks or months until someone makes an offer so the closing process remains uncertain.

These roadblocks become daunting for people who want swift house sales. Elite Properties offers a solution that eliminates both the financial burdens and the unpredictability of real estate deals.

What Makes Elite Properties Different

At Elite Properties, we do things differently. We are a reputable house-buying company focused on offering simple solutions for sellers. Here’s how:

- Cash Offers

The cash offers we make to customers eliminate the payment delays and financing requirements that traditional buying methods require. Our process enables you to sell without worrying about financing problems that could ruin the deal with buyers. - Sell As-Is

When you work with Elite Properties your home can be sold without repairs or improvement. You can sell your house in any condition because we don’t require roofing repairs, wall painting, or deep house cleaning. Our solutions handle every detail independently so you remain free to ignore all work. - No Fees or Commissions

Unlike traditional sales, you secure every cent of the cash offer when you sell your house to Elite Properties. - Flexible Timelines

Our service adjusts to your pre-established timeline no matter if you want immediate closing or need time to prepare your moving arrangements. Through the house-buying process, you dictate when each stage of the sale occurs.

How to Sell Your Home with Elite Properties

We’ve designed our process to be as simple and hassle-free as possible. Here’s how it works:

Step 1: Initial Contact

Contact us at 718-557-9261 or explore our website on the internet. The friendly members of our team will walk you through the steps and obtain essential details about your property.

Step 2: Property Evaluation

Our team evaluates two things about your property:

- Its current condition

- Market value

Evaluation happens speedily without requiring expensive appraisals or inspections for your property during this process.

Step 3: Receive a Cash Offer

After evaluating your property we will give you a no-obligation cash offer that matches the property’s fair value. At your own pace, you have the flexibility to determine what solution suits you best.

Step 4: Closing Process

Once you choose our offer, we will manage all necessary documentation and logistical requirements. The sale finalization process happens quickly as we aim to complete it within just a few days.

Step 5: Get Paid

Upon completion of the closing process, we will deliver your payment funds directly without any hold-up period whatsoever.

Why Choose Elite Properties

Selling your home with Elite Properties comes with unmatched benefits:

- Speed: Elite Properties lets you exchange months of waiting for swift home sales without delays.

- Convenience: With Elite Properties you avoid staging while receiving maintenance-free fast cash deals through streamlined sales processes.

- Stress-Free Process: Through us, you eliminate the stress of negotiating prices and inspections and avoid repair maintenance expenses.

- Flexibility: You can make a deal happen with flexibility by setting a personalized timeline as per your requirements.

Where Do We Operate

Elite Properties proudly serves homeowners across all five boroughs of New York:

- Brooklyn: With operations in both Williamsburg and Brownsville we offer town-wide property services.

- Queens: Our team has deep market knowledge across every part of Queens from Astoria to Flushing.

- Bronx: As a real estate firm we also work to help Bronx homeowners complete their sales without stress.

- Manhattan: We thrive in simplifying the property selling process even In the highly competitive Manhattan real estate market.

- Staten Island: If you need assistance in any part of Staten Island you can count on our team.

Real Stories: How We’ve Helped Homeowners

Here’s what a few of the many satisfied clients have to say:

Client 1: “Elite Properties made my home selling process very simple. The job relocation pressure drove me to move quickly which led to a swift cash transaction within seven days!”

Client 2: “I was overwhelmed by the thought of foreclosure until Elite Properties came to assist with a fair cash offer. The team protected my credit score as well as my mental peace.”

These stories highlight how Elite Properties transforms the home-selling experience for homeowners in need.

Conclusion: It’s Time To Sell Your Home with Confidence

At Elite Properties, we have redesigned the selling process to become fast, simple, and completely stress-free. Our trusted status as a professional house-buying company allows us to tailor solutions that let you walk forward in life.

Reach us at 718-557-9261 to start today or visit our website for your deserved cash offer. Elite Properties will manage your home sale process to provide you with a seamless transition to your next step in life.

Frequently Asked Questions (FAQs)

- When is the right time to sell my house?

Spring tends to be the preferred season due to heavy market interest though specific local conditions and lifestyle needs determine the optimal selling period.

- How do I figure out the best price for my home?

Home sellers can determine competitive pricing through local market research or by ordering a comparative market analysis CMA from licensed real estate experts.

- Do I need to repair my home before selling?

Selling your home as-is to a trusted buyer stands out as an excellent solution when time and resources run low even though property repairs have the potential to boost market value.

- What are the costs involved in selling a home?

The standard expenses, property sellers need to cover consist of agent commissions, closing expenses, property maintenance work, and house staging costs. Selling to Elite Properties saves property owners from having to pay numerous expenses.

- How long does it take to sell my house?

If you choose Elite Properties to sell your home it can happen in just several days instead of taking months like traditional sales.

Introduction

Mortgage deferment and forbearance are two options for homeowners that help in temporarily lowering their monthly mortgage payments. The major difference between these two options is whether the interest accrues and the time for repayment. Here, we will be talking about the difference between mortgage deferment and forbearance. There are multiple aspects when it comes to these methods like payments, interest, etc.

What’s the Difference Between Mortgage Deferment and Forbearance?

- Payment Assistance– In a mortgage deferment, the mortgage borrowers can delay past payments during the forbearance period. They can furthermore repay them at the end of the loan’s tenure. Here, as your mortgage payments are deferred, you are required to pay your monthly payments on time. Furthermore, forbearance pauses or reduces payments for homeowners suffering from financial hardships for a certain amount of time. Although the borrower has the option to make payments during the forbearance period, it’s not obligatory. In some cases, lenders may require the borrower to provide regular updates on their financial transactions during the forbearance period.

- Interest Accrual- In an interest accrual, the mortgage payments that have been deferred to the end of the loan’s tenure don’t accrue additional interest. Whereas, in forbearance, the interest accrues each month as scheduled.

- Repayment – Concerning repayment, in forbearance, you may have to catch up on the past payments post the forbearance period ends. Although, this depends solely on the loan and forbearance terms. For example, if your monthly payment structure is $1500 and you apply for 6 months of forbearance. You’ll owe $9000 towards the end of forbearance. Furthermore, deferment allows you to delay missed payments in case you sell your house or refinance.

What’s the Right Choice for You?

A deferment can be an ideal choice for you if you’ve come to the end of the forbearance period. You may benefit from deferment if you have just ended a period of forbearance. Also, if you are able to resume monthly payments but cannot afford to make up the payments missed during forbearance. This applies even to a repayment plan. Moreover, if you do not wish to permanently modify the loan terms you may be able to opt for deferment.

On the other hand, forbearance can be the right choice for one who is experiencing a brief period of financial hardship. This can be inclusive of job loss, illness, or any kind of disability. Here, you will have to provide proof stating the reason for the crisis.

Additional Information

COVID-19 may affect your ability to repay the outstanding payments. Although, under the CARES Act, you are able to request forbearance without providing documentation. If your loan is backed by either of the departments given below. You must have been requested an initial forbearance by September 30, 2021.

The departments are as follows-

- Department of Housing and Urban Development (HUD)

- Federal Housing Administration (FHA)

- United States Department of Agriculture (USDA)

- Department of Veterans Affairs (VA)

Furthermore, Fannie Mae and Freddie Mac do not impose a deadline for asking for an initial forbearance on your loan. Borrowers with federally backed mortgages won’t have to make a lump-sum payment at the end of the forbearance. Considering the COVID-19 adversity. Additionally, these borrowers will be eligible to defer the pending payments for up to 12 months.

The Bottom Line

According to the information above the conclusion is that forbearance provides momentary relief to homeowners suffering from the financial crisis. Although, at the end of the forbearance payments the monthly payments must be given in full. In such instances, homeowners may consider having deferment to postpone the one-time amount until the end of the loan’s tenure. Moreover, if you want to avoid the hassles and sell your house you can contact Elite Properties. We are a cash buying company which means we can help you sell your house fast for cash. Call us today at 718-977-5462 and sell your house in any condition and location.

A real estate agent plays a crucial role when buying or selling a home. Buying a home is a big deal hence, paying attention to every detail matters. Additionally, having a real estate agent on your side will help you in eluding multiple issues that come along with the home-buying process. If you’re new to the process then read our blog ‘The Dangers of Buying A Home Without a Real Estate Agent’

Paying Exorbitant Amounts of Money

Unless you don’t belong to the real estate industry you’d hardly know about the accurate prices of homes. Furthermore, if it’s an FSBO home (For-Sale-By-Owner) then, it’s likely that the owner is unaware of the pricing. In most FSBO cases, homeowners overprice the house. Reason being, a lack of knowledge and guidance.

When you hire a real estate agent, they offer you accurate information and provide you with a precise house price. They can give you a fair idea post-first viewing and rest after the completion of CMA(Comparative Market Analysis) or comparables(real estate appraisal term referring to properties with characteristics that are similar to a subject property whose value is being sought.). Additionally, they’ll offer you a suitable bidding price for your house that may take months to establish.

Issues with Disclosures

As a mandatory rule, disclosing problems related to a property is crucial whether it’s for an agent or a buyer. Although, in some places the rules may differ for instance in New York there is a rule known as Caveat Emptor. Caveat Emptor or buyer beware translates that a seller is not entitled to disclose known problems, if there’s an issue then it’ll be on you (seller). Although, major problems like structural issues still need disclosure.

Being Unaware Of The Neighborhood

A good real estate agent will know and understand your needs and the neighborhood that interests you. They will suggest the best neighborhood according to your requirements and value. Furthermore, they will also enlighten you about the market if it’s steep, low, or stable. If you research alone it’s almost impossible to be precise about prices in a city that you’re unfamiliar with. Moving to a new neighborhood is a big deal as you may spend most of your life residing there. Having a real estate agent at your side can identify potential problems in the neighborhood.

Problems while Appraisal

Paying an extravagant amount for a home can be bad, and seeking financing for the purchase is even worse. The case can worsen if you are buying an FSBO home. As none of the sides are represented the buyer eventually ends up paying more. Furthermore, when the home appraisal is run, the bank refuses to approve or sign off as the appraisal value is low and the amount is high. It’s a scary situation as the final price is settled and the seller doesn’t negotiate on the prices further.

Additional Problems

The situations above are some of the nightmares you would want to avoid by not hiring a real estate agent. Adding to the rest there are numerous other risks that you may fall prey to when you try to trade properties.

- Loss Of Time

Researching homes, potential buyers, neighborhoods, and buildings can take a toll on your head. Unless you’re a retired person or are currently unemployed you cannot afford to lose time and property.

- Too Much Paperwork

Real estate agents can be extremely complex with multiple verification processes and paperwork it can get tedious. Laws and regulations can differ from state, city, and region although, it comes inclusive of several documents that require signatures. Every detail counts and if you make any mistake it can cost you a fallthrough or delay.

- Numerous Lost Deals

The real estate market is highly competitive and constantly changing. Failing to make the right move on time can lose you out to other buyers that prepare beforehand. An agent’s job here is to make sure you’re ready to finalize deals and even win buyers/sellers respectively.

Bottom Line

No matter how much you may deny it, hiring a real estate agent will only help you ease the home-buying process. If you don’t have time to deal with a real estate agent you can get in touch with Elite Properties. We are a cash buying company and buy home as-is, we can close a deal in less than a week. This means you can move with the alignment of your timeline without having the need to disturb your schedule. Call us at 718-977-5462 and get to know more.

Let us be honest, we all have some itchy mortgage home loan questions that are difficult to ask. Opening up your personal life and finances can be uneasy. Borrowers may hesitate to talk on certain topics that can eventually lead to a troublesome mortgage home loan process. Read our blog ‘Are you embarrassed to ask these mortgage home loan questions?’, and elude yourself from being in an uncomfortable situation.

If you are hesitant to ask questions that you feel may put you in a compromising state, think again. Loan officers hear it all the time and they have answers to all your questions. Some of the questions are given below.

Is It Possible To Get A Mortgage Home Loan Without A Job?

The first step to qualifying for a mortgage home loan is employment verification. Your lending institution will look at your debt-to-income ratio, W2s for the past 2 years, etch, to understand your finances. Now, the question is what happens if you lose your job during the home-buying process? Firstly, it’s important for a buyer to be honest with the loan officer and disclose every little detail. Hiding the situation will only get you in trouble and increase the risk of loan default. The loan officer, in this case, will recalculate your savings/earnings and submit a new mortgage application.

Although, you may still qualify for a smaller loan and get a house in that price range.

How Do I Take An Ex-Off My Mortgage Post Separation?

There are usually two options available in this case

- Sell your house

- Let one spouse buy out other

Selling your house and dividing the yields is the most suitable option to resolve the issue of homeownership. Here, the spouses need to settle on a buyout figure (i.e. the home’s appraised value minus the selling price). The remaining amount will be split between the spouses. Furthermore, the spouse keeping the house may decide to employ a mortgage refinance to pay the buyout. So when you purchase back home with this option it will eventually remove the other partner from the property’s title.

What Happens To The Mortgage Loan If I File For Bankruptcy?

Keeping your home while facing bankruptcy is probably one of the biggest concerns for homeowners. Legally, a mortgage lender cannot punish you for filing a bankruptcy either way by changing your loan terms or raising your rate. Although, the cases are different keep in mind several factors and circumstances. Homeowners filing for chapter 7 bankruptcy may risk losing their homes. Whereas, homeowners filing for chapter 13 bankruptcy may keep their home and continue paying their mortgage home loan.

Does It Matter In Case I Owe Back Child Support?

A child support arrear can be a negative sign on your credit that may lead to failure of mortgage prequalification. Additionally, back child support that has reached the judgment phase may make you appear as a risk to the lender. You may want to consider talking openly to your loan officer about the ways you’re trying to pay the debt. It may also possibly improve the odds of qualifying for loan eligibility.

The loan officer may also ask you for a court-approved repayment plan to know how you’re managing your debt. Furthermore, paying the debt in full can also ease the toll of credit and qualify you for mortgage programs.

- I Didn’t Pay My Property Taxes And Got A Letter From The Lender. What Do I Do?

The reason homeowners pay taxes is to fund the municipal services and county. If you fail to pay the property tax bill, the local tax office will commence charging monthly interest. Additionally, you may also have to pay penalty charges for overdue payments. If this becomes a continuous thing a tax lien will be put on your property. The lien indicates you can’t sell the property until the tax bill is paid.

If you receive a tax notice from your lender, then it’s crucial to contact the tax attorney and your loan officer. Failure of property tax payment translates into the ‘event of default’ that will put you at risk of foreclosure.

There are some options that your loan officer may guide you through

- Allowing late payments

- Seeking a tax deferral

- Creating a payment plan

- Taking out a property tax loan to pay a debt in monthly installments

- Why Is It Important To Know Where The Money Deposited In My Account Comes From?

While the mortgage approval process, large deposits of money that are apart from your earnings need an explanation. An underwriter will ask for verification of the large money deposit, to ensure it comes from an admissible source. Confirmation of the deposit also ensures if you’ve taken a new loan that potentially affects your debt-to-income ratio.

- I Am Unable To Make My Mortgage Payment, What Do I Do?

If you think foreclosure is the only way out if you default on mortgage payments, think again. There are several options available, one of which is to contact your loan officer. Your officer will ask you about the financial crisis and why you won’t be able to make payments moving forward. The objective of the officer here is to help you to keep your house and explore the possibilities. There are options like loan modification, mortgage refinance, repayment plans, forbearance, mortgage assistance programs, or short sale. These options can be a big consideration before the homeowner faces bankruptcy.

Additionally, the Consumer Financial Protection Bureau recommends a free HUD-approved housing counselor. Having a counselor by your side can aid in receiving professional guidance and saving you from foreclosure.

Bottom Line

Having awkward questions is okay as far as you have solutions for them. Although, if you want to avoid such situations you can sell your house to Elite Properties. We buy houses as-is and offer you the authentic fair market value of your house. Call us today at 718-977-5462 and sell your house fast for cash.

In order to assess property taxes, localities usually have a home appraisal. When you sell your house or refinance it, the bank is liable to order an independent appraisal. This is done to assure it is lending against the property’s true value. The satisfaction of a home appraisal relies on if you are a seller, a prospective buyer, or a taxpayer. If you’re someone who is unhappy with their home appraisal, scroll down to read our blog ‘This Is How You Can Challenge A Low Home Appraisal’.

A thing to keep in mind is that not all homes are up for appraisals if you are a cash buyer you can opt-out. Although, this only happens when the price inclines on the steeper end of the market and the inventory is low. However, if you are planning to finance your new home appraisal is mandatory. On the other hand, according to most housing experts, if you are paying for your house in cash, it is always better to know its worth.

The Multiple Kind of Appraisals

To understand better make sure you are aware of the multiple types of appraisals.

- Online Appraisal

Many companies nowadays have started performing electronic appraisals to cut costs. Here, they do internet research on comps (comparable homes) to fix the value of your home based on comps and other factors inclusively. Although, in an online appraisal there is a high chance that information on newly renovated rooms or items can be skipped. If something like this occurs, it might impact the assessment of your house as these things are not visible online.

- County Appraisals

Drive-by appraisals are another kind of appraisal that usually takes place for counties. In drive-by appraisals, a person may take the current picture of their home and comparables, again without the need to visit the house.

- Traditional Appraisal

Lastly, the traditional appraisal occurs when the appraiser visits the house and gathers information. The appraiser further asks questions regarding improvements. Post which he/she will make a comparison to other similar houses in the area or town. Furthermore, a traditional appraisal may cost several dollars and takes place when a home is sold to the new owner.

Here’s How To Challenge A County Appraisal

The reason for conducting a county appraisal is to assess property taxes based on the current value of your home. If you aren’t thinking of moving any time soon, and when the assessment comes in lower than your expectations. A thing to consider is that your property tax bill will also be less. Additionally, if you want to sell your house in the future you can call the county auditor. There are many localities that allow you to appeal the assessment by providing proof of upgrades or improvements.

Furthermore, while evaluating the property a real estate agent researches the comps in the area. This means using the county’s assessed value may not hold as much importance.

Here’s How You Can Challenge Other Appraisals

If you’re buying a house and the appraisal comes in too low, it will result in declining your mortgage loan approval from the lender. Although, you still have multiple options to try before giving up.

First off, as the purchaser of the appraisal, you are entitled to view the appraisal. Make sure to work closely with the seller’s real estate agent and ensure all major upgrades are taken care off while the assessment. Additionally, ask the seller’s real estate agent to talk to the appraiser about the comps they examined while finalizing the selling price.

You can also request the appraiser to re-examine their results based on comparables. If there are a handful of recent sales in the neighborhood. The appraiser may have found similar homes in other neighborhoods that weren’t comparable as initially thought. If you can provide authentic information to the appraiser there is a possibility they might reconsider the assessment.

Lastly, remember to always be polite while challenging an appraisal. The appraiser may not want to admit that they’re wrong while putting in a place of defense. Make sure you challenge the assessment with absolute respect and talk it through.

Conclusion

There might be times when a low appraisal may work in your favor regardless of your status. Remember, an appraisal relies on multiple factors starting from the home’s condition, its market value, and comparables.

Furthermore, if you have strict time constraints and are planning to sell your house fast you can get in touch with Elite Properties. We buy houses for cash and make an offer based on the fair market value. Also, we offer fast closings so that you can work according to your timeline. Call us today at 718-977-5462 to know more.

The biggest perk of being a homeowner is you can build home equity over the period of repayment. As you pay the mortgage your equity in a home increases simultaneously. Additionally, a Home Equity Line Of Credit (HELOC) is a financial product enabling homeowners to borrow a chunk of that equity against their homes. If you are someone who is thinking of using HELOC apart from securing a second mortgage loan; read our blog about why avoid using your home equity line of credit. And make a decision later.

What Is Home Equity?

Home equity or also known as real property value is the unencumbered interest of a property. It is the difference between your home’s worth and the outstanding balance of all credits on the property.

Example – Your home’s worth is $300,000 and you’ve paid $25,000 of the mortgage. Additionally, you’ve put down 20% ($60,000) which signifies you have $85000 equity in the home.

What Is A Home Equity Line Of Credit?

A HELOC (Home Equity Line Of Credit) is similar to a credit card. Although the limit is purely based on the equity you have in your home, most banks offer about 80% of your equity. HELOCs often have a lower interest rate in comparison to other loans and the interest may be tax-deductible.

As HELOCs have a lot to offer, using them for leisure and entertainment can be an indicator that you are misusing the allowance. Even if the HELOC is cheaper than a credit card, it is still a debt that must be avoided for funding a luxurious lifestyle. Given are some of the activities you must avoid while using your home equity line of credit.

Paying For A Vacation

Adding to other activities, spending your home equity line of credit on a vacation can be a bad decision. HELOCs are a source of cheaper debt in comparison to other kinds of credits, people use them for sponsoring trips. Also, the HELOC offers interest rates below 6% whereas credit cards may be on the steeper end offering 14%-25% interest rates. When you borrow from the home equity you are only aggravating the issue, as you may be risking your home while using HELOCs.

Buying A Car

There was a time where HELOC rates were reasonably cheaper than auto loans. Eventually, the cheaper rates enticed people, enabling them to use HELOCs although it’s not the case anymore. Furthermore, buying a vehicle or car, in this case, is a bad idea for many reasons. When you take an auto loan with a HELOC your loan is secured by the car you purchased. If your financial condition worsens you may end up losing the car. Additionally, if you’re unable to make repayments you may also lose your house. Adding to the rest, an automobile is a depreciating asset.

Paying Off Credit Card Debt

When calculating your repayments paying off expensive debt with cheaper debt may make a lot of sense. However, in some cases, this debt transfer can skip the underlying issue, which is a lack/shortage of income or inadequacy to control spending. It is vital to understand what led you to create credit card debt in the first place. You can only pay a credit card debt if you have the discipline to pay the principal of the loan initially.

Paying For College Education

The primary reason for people using HELOCs as mentioned above is because it’s cheaper than other credits. This makes it a big reason for using it for your child’s college education, however, using HELOCs may put your house at risk. You may have to think twice before using the home equity line of credit as it may risk losing your house. Additionally, if the amount is significant and you’re unable to pay the principal within 10 years. You may carry the added burden of mortgage debt into retirement.

Investing In Real Estate

Should I invest in real estate with HELOCs? The ultimate answer to this question is that it’s a risky proposition. There are many uncertain circumstances that may affect this decision. Reasons like sudden renovation, or a downturn in the real estate market, etc. can be a pitfall. Due to the same reason, many people have been trapped in debt, which makes repaying a tough task.

Bottom Line

There are many other ways to fund your requisites apart from HELOCs may it be for education, getting a car, or planning a trip. It is best to avoid using the home equity line of credit and use your savings or other available credit options. Furthermore, if you want to sell your house fast you can get in touch with Elite Properties. We are a cash buying company offering fast closings and no-obligation offers. Call us today at 718-977-5462 to know more.

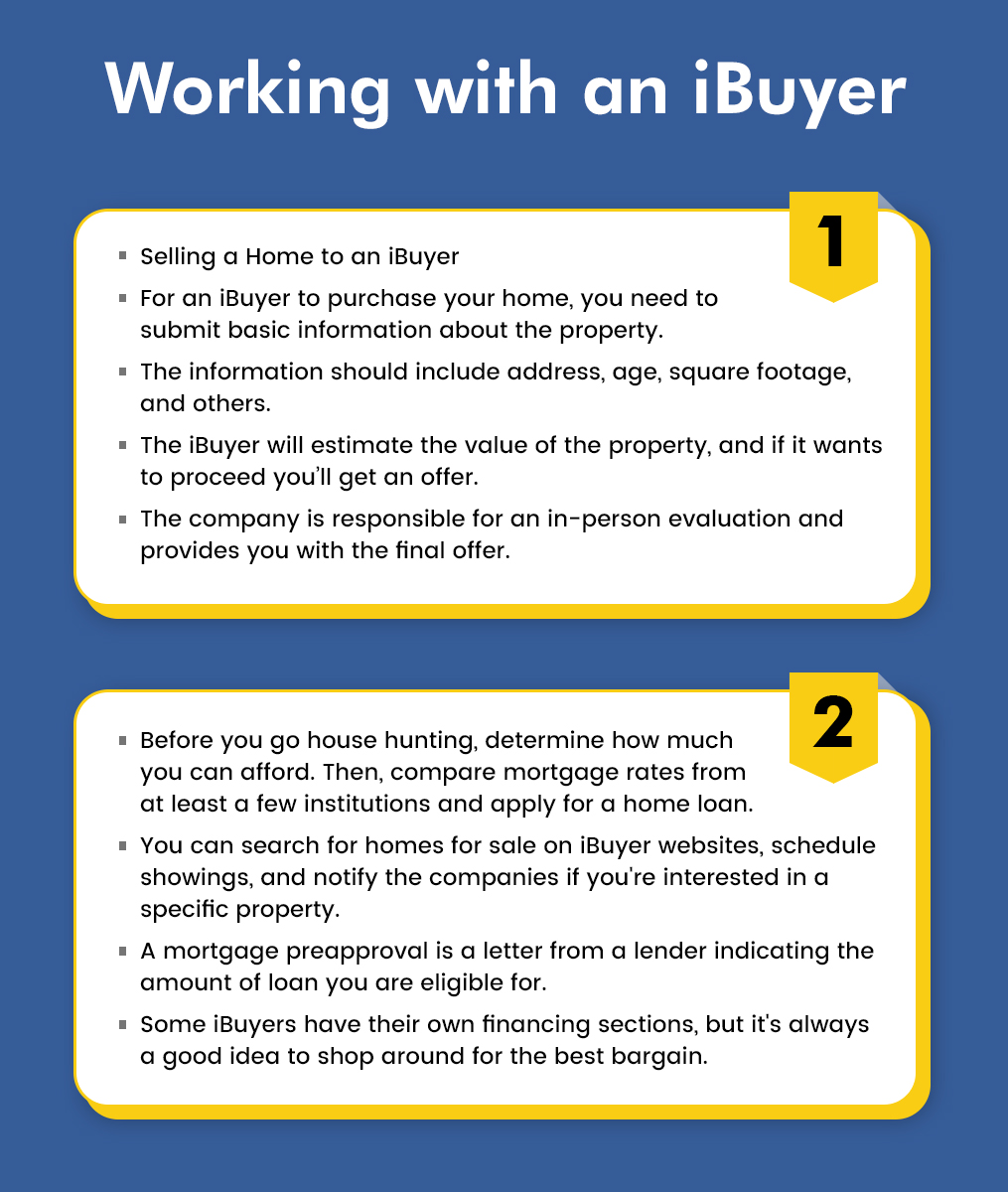

The facade of real estate has changed with time and new-age processes like virtual tours, virtual staging, advertising online, etc. , are pulling the limelight. With the moving age of the internet selling and buying is as easy as a click. The dynamics of business are constantly evolving whether it’s real estate or groceries. People prefer convenient alternatives rather than the traditional home selling process. Nowadays, people are attracted to iBuying, don’t know what is it? Scroll through our blog, ‘Is iBuying Worth The Hype? What is an iBuyer?’ to know more about the topic.

What Is An iBuyer?

To put it in simple words, an iBuyer is a company with ample finances that makes an offer on your behalf based on algorithms. The term “iBuyer” is a fusion of words where I denote ‘instant’ combined with the word ‘buyer’. The company makes all the trades and makes the whole process convenient for both buyers and sellers. iBuyers try to sell your house with a profit margin and give you cash in return once sold.

iBuyers buy your house as-is which means selling your house without spending a ton of money. It enables a buyer to avoid the extra upfront costs that incur while closing. Additionally, it avoids the need for real estate agents or brokers.

How Does An iBuying Model Work?

As given above iBuyers use algorithms to determine the ideal price of a home, which are based on comps (comparables). The iBuyers provide instant offers to sellers in as few as 24 hours once you fill out the requisites in the form. A potential seller will have to go to the iBuying website and fill out a form, post which they receive an offer. For instance, if the seller accepts the offer then the sale is likely to close in just a few weeks.

How do iBuyers make profits?

iBuyers usually buy a property with a discount as-is. They add value to the property by making minor improvements to optimize the selling price post which they list on MLS. Additionally, iBuyers provide an in-house financing service to customers which helps in earning good profits. A service charge typically ranges from 5% (can be higher or lower, relies on the tenure of selling your house)

Pros And Cons Of Selling Your Home To An iBuyer

iBuying is a great way to close deals fast, although it comes with a set of pros and cons. Some of them are given below.

Pros of iBuying

- Capable of fast closings (as less as a couple of weeks)

- Avoid the hassles of legal verification, inspection, or appraisals

- Does not require walkthroughs

- Avoid paying the upfronts costs while closing deals

Cons of iBuying

- May require some amount as a listing fee, which is usually higher than a real estate commission

- Currently, only a few iBuying companies are active and providing services

- Less selling prices, usually below the fair market value

- In most iBuying models the house may have to satisfy the ideal house criteria

Is iBuying Really Worth It?

Whatever method you use to sell your house whether it’s a traditional home sale or iBuying, will have some advantages and disadvantages. It is all about what suits you best. Although, if you choose to sell through an iBuyer, make sure to do your due diligence. Besides, it is equally important to go through all the fine print and policies including the other costs and fees if any.

Conclusion

If you are someone who wants to sell your house fast and doesn’t have enough time to wait? You can get in touch with Elite Properties. We buy houses for cash online in New York and offer you enticing deals over your as-is property. Furthermore, if you wish to learn more about a house sale then call us at 718-977-5462, we’ll be happy to help.

Staging is a way to market your property for better profits.

What is Virtual Staging?

Like traditional staging, it is an innovative marketing technique that showcases multiple features of your house. It is a method to entice prospects and convert them into buyers. If you are planning to sell your house, then you must try to impress potential buyers with virtual staging.

A virtual staging as the name says is done virtually with the help of computer software that shows various uses of spaces/rooms. It includes demonstrating the potential placement of the decor, furniture, accessories, appliances, etc., in high definition.

Ideal Spaces For Virtual Staging

To begin with, virtual staging is best suited to vacant properties. If your home is occupied with furniture and other stuff you might want to opt for traditional staging. Although vacant homes, homes with obsolete furniture, and houses that have tenants are ideal spaces for staging.

What Is Better, Virtual Staging Vs. Traditional Staging?

When it comes to staging, this staging is a lot cheaper than a traditional one. A traditional staging will cost you several hundred dollars a month although, it is completely dependent on the stager you hire. Additionally, the prices may vary depending on the type and quantity of furniture you rent and the number of rooms that require staging. On the other hand, this staging may cost you anywhere from 39-199 dollars per room. Again, this is all reliant on the contractor, the number of rooms, the location, and the spaces that require staging.

Pros And Cons Of Virtual Staging

If done right, it can be a great way to sell your house fast. You will need a professional stager and will have to work with a reputable company with a wide and fine portfolio of completed projects.

Pros of virtual staging –

- Highlight the best features of your room/house

- Cost-efficient

- Best way to entice buyers and sell properties online

- Customizable to stage the number of rooms

Cons of virtual staging –

- Can be a little expensive while remove furniture or other items from pictures

- Can be difficult if the room is occupied unless you have vacant room pictures handy

- The furniture and decor are not real and only exist in a virtual space

Pros And Cons Of Traditional Staging

A traditional staging doesn’t always require a professional stager. Although, hiring a professional provides an eye for detail and creates a space that entices buyers. Besides, there are some pros and cons of traditional staging.

Pros of traditional staging –

- Provides a real-life perspective while walkthroughs to buyers

- Can make spaces appear larger and enable buyers to gauge the size of the space

- Does not require a professional stager

Cons of traditional staging –

- Can be on the expensive side

- Extra upfront costs for furniture and decor

- Can be an extra pile of work as the market can be uncertain in terms of selling your house

Virtual Staging Mistakes To Avoid

Hiring a virtual staging company that is not up to the mark can be a potential mistake. The virtually staged pictures must look so realistic that buyers fail to recognize it’s computer-generated.

Other mistakes most people make are –

- Buyers tend to imagine things as they are shown virtually. It is vital to provide buyers with vacant and staged room images that offer a better perspective to their imagination.

- The second mistake is staging the house for the worse instead of making it look appealing. Remember overdoing the furniture and decor will only make the room look chaotic and not pleasing.

- Lastly, using virtual staging when it’s not needed. If your property looks fine just by shifting furniture and changing the rugs then it is advisable to avoid this type of staging.

Is It Possible To Sell Your House With Virtual Staging?

Virtual staging can be a big asset while you sell your house. Although, there are some points you might want to touch down before hiring a staging company. Avoid over or underdoing, creating a balanced look will do wonders. Virtual staging can help you sell your house fast, but if you want to avoid the hassles of hiring a stager you can sell your house as-is to Elite Properties NY. Call us today at 718-977-5462 and learn about how to sell your house for cash.