There is always a debate amongst people about what is better. Buying a House Cash vs Mortgage? In this blog, we will try to clear the picture and try to help you in the home selling process. A lot of finance experts say buying a house in cash can avoid drowning in debt. Although, the other half believes in getting a mortgage and repaying it over the 15/30-year mortgage. Every method of purchasing an asset has its pros and cons. We will share an overview of each method and how it varies in each situation.

Why Must One Buy House in Cash?

In simple terms buying your home in cash allows you to avoid foreclosures and you are free of debt. You have complete ownership of your assets as you buy the property in full cash. Although every scenario has its pros and cons, scroll down below to know more.

Pros Of Buying a House in Cash

-

Free Monthly Cash Flow

One of the big reasons to buy a house in cash is free cash flow. If you buy a house in cash you aren’t entitled to pay monthly mortgage installments. It allows your income source in multiple bifurcations as per your convenience and needs. Although, you’d still be paying the homeowners association fees, property taxes and maintenance costs, homeowners insurance, etc. You will pay these extra costs even if you don’t get your house on mortgage. When you buy a house on a mortgage, you pay a big chunk to the lender whereas in this case, you avoid it entirely.

-

Save A Lot on the Interest

If you purchase a house in cash, you can save a lot on the interest of the mortgage. When you take out a mortgage, the interest rates are bound to escalate over the tenure. Example: A mortgage of $170,000 having a 4.375% interest rate costs you around $135,000 as interest expense for 30 years. Furthermore, mortgage debts are one of the cheapest in the USA if calculated on the APR (Annual Percentage Rate) basis. So, buying your home in cash might save a big chunk on the repayment.

-

You Are a Preferred Prospect

Sellers always prefer cash buyers as the deal closes faster. When a seller sells the property to a cash buyer, it only requires the buyer’s due diligence and mutual closing date. Whereas, when a buyer applies for a mortgage, he/she has to work on a lot of things. Things like the verification process, legal documentation, the underwriting process, etc. The real estate market is big, but sellers usually pick cash offers as they are enticing and close faster. Also, a cash offer allows negotiation in closing costs as you trade in hard cash. If you are a cash buyer, you’ll be the preferred prospect instead of the one with a mortgage.

-

Faster Closings and Lower Closing Costs

When you buy a house in cash, you avoid paying the associated loan fees. Also, costs like the originating fee, mortgage insurance premium, credit card report fee, etc. A cash offer may help you get away with legal processes and verification. Remember, an all-cash offer is less than the traditional bidding price. Getting paid in hard cash eventually is better than the orthodox mortgage bid, which is time-consuming. Additionally, as stated above, you close a deal faster with flexible closing costs.

Cons Of Buying a House in Cash

-

Tying a Lot of Money into One Asset

If your property is worth $150,000 and you are a cash buyer, it can be quite risky. If you invest a large amount of your savings in one asset, you are tying up a lot of money. Such transactions do not show a positive outcome on your credit score.

-

Low Liquidity

The real estate market or a house is an illiquid asset, which means it is difficult to sell it fast. Selling a home is time-consuming and a daunting task. Assets like bonds and stocks which have high liquidity are easy and quick to resell whereas a house is not. Therefore, putting a lump sum amount in one asset is never ideal as it slumps access to the liquid assets.

-

Missing Out on Tax Benefits

The itemized taxes may help in putting the money back in your kitty. You can deduct a lot of amounts on mortgage rates through itemized taxes. Itemized tax deductions levy on multiple assets; it is advisable to check the taxes before purchasing. If you are using cash as your primary payment source then you are definitely losing some good tax benefits.

-

You Are Left with No Savings

Buying a house in cash blocks your savings, and you have nothing, which means no emergency funds. It is always advisable to keep petty cash handy during an unexpected crisis.

Why You Must Consider Getting a Mortgage?

Buying a house on a mortgage allows you to maintain your savings and caters to the funding. Many people do not have enough savings to buy a house in cash. Prospects get a mortgage and keep building the equity over the tenure of repayment.

Pros Of Buying a House on a Mortgage.

-

Flexibility Savings

When you get a mortgage, you have the flexibility to put your savings into other investments, which promise good returns. You can pick from innumerable liquid investments and grow your wealth and manage your monthly payments as well. Buying a house on a mortgage is always a better option as you have more flexibility to manage the money.

-

Low Mortgage Rates

Comprehending the pandemic and the current state of the market, it’s a better option to opt for a mortgage. The mortgage rates are low, and the inventory has houses sitting for potential buyers. Hence the above makes it an ideal situation for purchasing a home.

-

Improve Your Credit Score

If your credit report shows timely repayments, you will ultimately have a good credit score. Unlike buying a house with cash, it is essential to show the diversity of debts for a better credit profile. Credit reporting agencies prefer timely repayments of debts including home loans. It improvises the borrower’s profile allowing them to get a faster mortgage and boosting their credit score.

-

Advantages Of the Tax Deduction

Mortgage debts are tax-deductible, which means more benefits for the person getting a mortgage. Married couples planning to buy a home can write off interest taxes up to $750,000 if filing together. If you are filing separately, you can write off tax interest up to $375,000. Post the tax reform in the year 2018 write-offs were not as profitable. Although it still is beneficial for homeowners with outstanding mortgages.

Cons Of Buying a House on Mortgage.

-

The Intricate Mortgage Process

It’s no hidden truth that getting a mortgage can be a really daunting and tiring process. You have to keep track of all financial documents inclusive of your IDs, which can be frustrating at times. Lenders will ask you for every detail and if you miss even a single document, you won’t qualify for the loan.

-

Paying Mortgage Insurance Premiums

When you pay less than 20% on the property, having a mortgage insurance premium will be mandatory. A mortgage insurance premium is an addition to your monthly mortgage payments. Insurance is an added cost to secure the lenders in events if you miss out on paying the installments.

-

Drawback Of Additional Costs

When a mortgage has lenders involved, it always comes with extra costs. The buyers are liable to pay lender fees, closing costs, mortgage origination fees, and appraisal fees. These additional fees can add to the existing cost and make the purchase even more costly.

-

You Still Don’t Have the Ownership of the Property

When you buy a house on a mortgage, the lender has ownership while you keep making the monthly payments. They are entitled to hold your property until the last installment. If you fail to pay a consecutive number of installments, there is a high risk of losing your home.

Bottom Line

We know buying and selling a home is an overwhelming task. It can be a very confusing, lengthy, and mentally draining process. We tried to cover the pros and cons of buying a house in cash or by getting a mortgage. So, choose wisely keeping in mind your monetary status and plan futuristically.

If you are planning to sell your house fast for cash in NY, get in touch with Elite Properties. It is a ‘We Buy Houses For Cash Company’ which means you can sell your house fast for cash. Give us a call on this number at 718-977-5462 and we’ll help with fast home selling.

Losing your job is a very tense and stressful situation after which selling your house becomes the only feasible option. The burden of covering insurance and mortgage stands to be the need of the hour. In such circumstances, you wouldn’t want to wait for the traditional home selling process which can take months or even years. If you want to learn about the topic of ‘How do I sell my house fast after a job loss?’ scroll down below to get the insights.

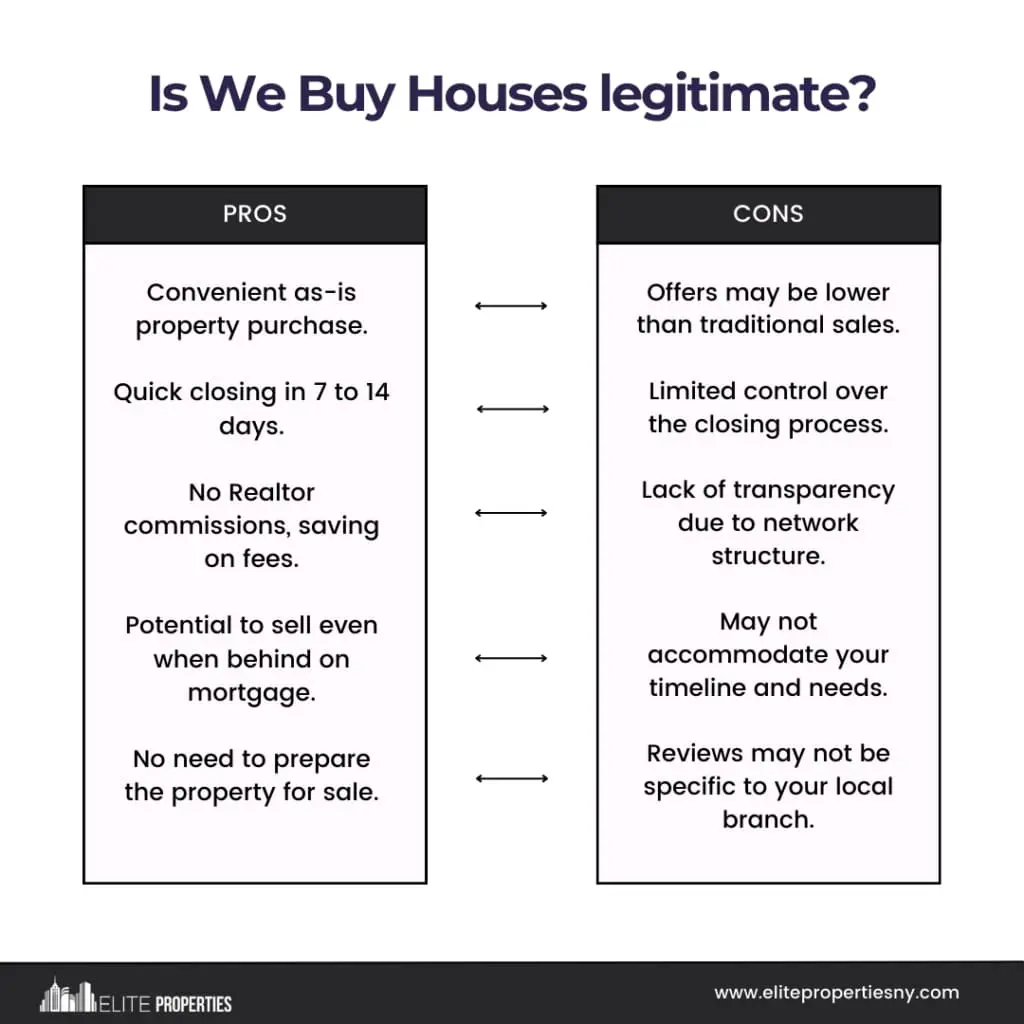

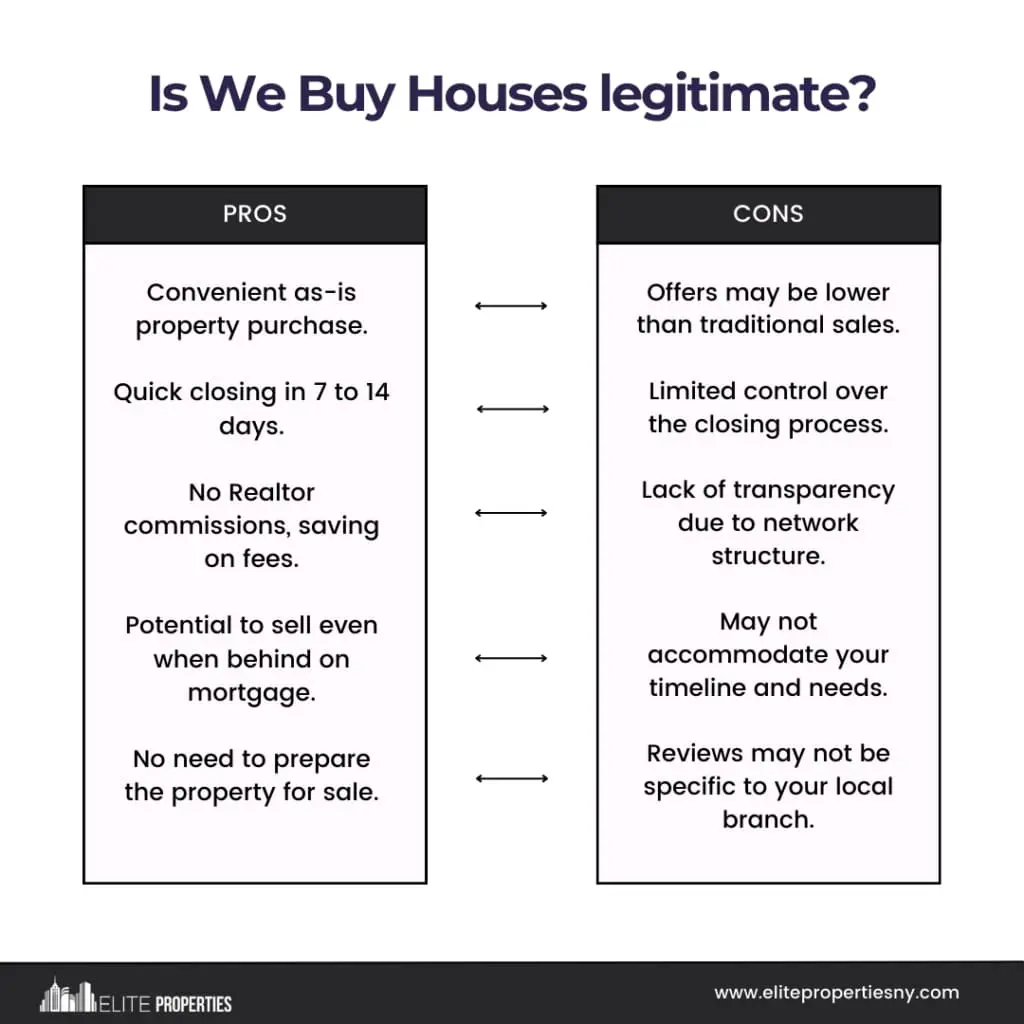

Selling your house to ‘we buy houses for cash’ company will help you in many ways especially when a financial crisis comes into play. Many foreclosures occur due to job loss and unemployment or homeowners’ lack of cash, which becomes a problem while you pay mortgage or insurance. As a fact, foreclosures can lead you to bankruptcy and you won’t be given any loan further as your credit score is affected.

Avoid the Hassles of Clean-Up and Repairs

In such tight constraints, it is almost impossible to give an aesthetic change to your house. Making physical changes or cleaning your house can be time – consuming whereas, staging your home can be extremely costly. Furthermore, it is difficult to find buyers who would buy your house in a traditional way. Here, you can get in touch with ‘we buy house as-is’ companies and they will take care of the rest. There is no need to spend a dime on de-cluttering of your house, staging, or improving the curb appeal, once you get in touch with them.

No Need to Listing Your House on the Market

Listing your home on the market requires a lot of time, the process can last up to many months until you have found a serious buyer. People end up hiring a real estate agent which again is an additional cost while they have a naught budget. An Agent will always end up advising you to stage your home and make it presentable before you list the home on the market. Not forgetting, you will have to pay around 6% commission for the services they provide adding to the rest, closing costs and tax fees are the left-out aspects that round up the deal while closing.

You can also chuck the process of the walkthrough, as it typifies energy, money, and time consumption. It is a long process that doesn’t elude the havoc created by inviting strangers to have a look around your place. Showings additionally can hamper your timeline as well, instead of finding ways to achieve an income source you end up showing your house to strangers who’d hardly care to buy.

Sell Your House Fast For Cash

Lastly, all you can do is sell your house fast for cash and save yourself from the frustration of the home selling process. Selling your house to Elite Properties can save a lot of your time and money altogether in one, how? We are a cash buying company which means we buy your house as-is without any commissions lying in the middle of the road. We propose you a no-obligation offer and buy your house at the current market value which means; only profit and no loss. We also pay the legal fees and closing costs. It is also advised you do some research around the neighborhood and get insights into selling your house.

The most feasible option is to sell your house as-is to us, rest assured we’ll help you in this tough situation. Call us today at 718-977-5462 or visit us at Elite Properties.

Selling Your Home as is for Cash doesn’t have to be costly. Your home is a big asset and you wouldn’t want to spend a lot and get less than the desired value. You might be thinking that selling a house will be expensive and never-ending, which is partially true. However, we would like to tell you how you can find ways to save money while selling your home quickly and cherish the yields of the sale.

Sell Your House for Cash

Selling your house for cash is the most feasible solution while selling your home, how? Selling a house for cash has several perks, the sale closes in a much faster timeline, which allows you to proceed with your timeline. Second, if you choose Elite Properties you can sell your house within 3 days, so if you have a tight deadline, you have a solution. Third, you are offered an all-cash offer which means you have immediate cash for your next purchase.

Avoid Real Estate Agents

As much as real estate agents are saviors in the home selling process sometimes it’s better not to pick them.

Why?

Hiring a real estate agent has many pros, but in the specified situation, there are none. When you hire an agent you are automatically liable to pay the fees in multiple facets like commission and sale profits. Paying additional costs might decrease the value of your sale and would not produce any profits. In the worst-case scenario, you would end up spending a lot rather than saving. Also, an agent will take his or her time to make a fast-paced sale which will again cost you dollars.

For Sale By Owner

A ‘For Sale By Owner’ or FSBO listing is one thing that is accessible while trying to save money. The process can save you loads of money and can guarantee a profitable sale. There are many phases to such kind of a sale like; walkthroughs, attending prospects, marketing your property, etc. which will be solely done by yourself. Handling all these things at once might be challenging as it consumes a lot of your time. As a drawback, conducting showings and attending prospects personally will hamper your daily routine. You’ll have to perform repairs by yourself instead of a handyman, remember leave no space for any glitches.

Although, you can utilize the digital era to your advantage, taking pictures of your property (some exclusive drone shots) will help entice prospective buyers. You can list your property online for free on social media platforms that will serve you in gaining positive attention. By doing this you are cutting the costs of hiring a photographer and a broker which typifies an expenditure of more than a hundred dollars.

Sell House With Repair Discounts

Selling your house with repair discounts is the finest option to get away from a rugged property. If a part of your house is in bad condition or requires a little more than repair, you can list your property with a repair discount. A repair discount is when you sell your home by cutting a little chunk of the amount as a credit to the buyer to make further renovations. So instead of spending your equity, you can let the buyer make renovations according to his or her desired taste. Also, when you make repairs on your own the estimate will add construction costs, which is a mandated expense to your budget. You can sell your house in as-is condition to buy houses from cash companies it is one of the best options rather than doing repairs by yourself.

Consider DIY

As stated above doing things on your own will save you from bleeding dollars from your pocket. Your home is probably functioning great but what about aesthetics? You would require a painter, a handyman, and for minimal repairs probably a plumber. Hiring people for each job can be time, energy, and most importantly money consuming. Consider the ‘Do It Yourself technique, you can perform many things on your own like painting, cleaning, staging (if required), and repairing. This will work like magic on your estimates, as a result, you’ll save thousands of dollars, which helps in retaining your equity. Although DIYs are fun to do, you also have to keep in mind they will require all your efforts and time which you are surely running out of.

Sell Your House As-Is

Selling your house as-is is a better option than FSBO, how? FSBO listing will take up a lot of your time and energy whereas selling your home as-is will need none. This process doesn’t require a lot of time or any legal documentation as well. Selling your house as-is to cash buying companies will offer you a fair market value of your home by considering the condition of your house as well. They will also propose to you an all-cash, no-obligation offer which is a cherry on the cake.

If you want to sell your house fast for cash or have any queries regarding the real estate crisis we will be happy to help you. Get in touch with us today to learn more about ‘How can you save money while selling home’. Reach us at 718-977-5462 and we will provide quality solutions for all your problems.

A home is an extremely big asset for couples. When a couple chooses to separate, the relationship as well as the house also goes through a lot. A divorce comes with a lot of deliberations and mutual agreements which is important for the long run. Here, your part is to decide whether you want to sell your house or buy out to your spouse. Given below is a guide to Sell Your Home fast after the divorce which will help you with your existing chaotic situations.

If you have chosen to sell your house, there are many things down the lane waiting for you. Selling your home is a long and lengthy process, it isn’t a smooth run. In such a case, the best way out of it is to talk it out with your partner. Mutual decisions go a long way and where real estate is involved it can be extremely expensive and hard on pockets. It is the tight sure way to Sell Your Home fast.

Sell and Split

The best option which will reduce the disagreements is selling your house and splitting the proceeds of the sale equally. Why selling your house is a feasible option? First, neither of the spouses can afford the maintenance of the property. If the couple has kids it can double the expenses, with the ongoing expenses of divorce it can be a tough situation to tackle. Selling your house for cash is a feasible option because the proceeds of the sale can be split equally. Therefore, selling your house is an optimal solution for multiple reasons.

Buy Out the House

The second option is to buy out the house which means; the spouse who wants to maintain the ownership would recompense the other with half of the share. They can share a part or whole value of the house which can be transferred to the other half as a settlement of the divorce. Here, the spouse on the receiving end gets to keep a part of the house and receive the calculated share once it is sold.

Hold On To the House

If a couple with children is getting divorced, they would choose to hold on to the house. In this case, the couple can hold on without altering the ownership. You can choose to stay until your children move out for work. This can only happen when the couple can bear each other’s differences and think financially.

Sorting Out the Mortgage

Before taking a step to sell your home, you will be accountable to ask questions yourself. Questions like what are your income requirements if you chose to keep the house and retain ownership? What aspects would come into play if you sell your house? Will my children be affected by the decision, what are their needs? Etc. Once you know the answers, you can move ahead.

If a couple has a joint mortgage, they usually prefer to sort the mortgage on a single name (either of the spouse’s names). It is beneficial from both sides because the person residing in the house won’t rely on another half for the mortgage. Lastly, the person who discards the name from the mortgage can lend more money for a new home as they are exempt from the joint mortgage.

Understanding Your Property Rights

A house is an immensely big asset for one to keep. If you are going through a divorce, it becomes necessary to protect and understand your property rights. Securing property rights saves you from any felonies that your partner does without any knowledge. Home rights ensure neither partner can’t be forced to vacate the home even if it is under their ownership or not.

It is important to be aware of the laws and regulations while going through a divorce. The “Family Law Act” gives access to:

- Staying in your home unless a court order states to vacate the residence

- You will be notified of any repossession action taken by your mortgage lender

- If you have moved out, you can urge the court to grant permission for returning back

Sell your house fast for cash

As stated earlier in the blog, selling your house is the fastest solution after a divorce. Selling your home to cash buying companies eludes the chaos of legal processes and additional costs. Elite Properties is a reliable company when you choose to sell your house fast for cash. We buy houses all cash so you can sell your house within 3 days and move on with a new life. Rest assured we will buy a house in any condition, any location.

A divorce is a tiresome process that can drain you mentally. To Sell Your Home fast for cash will save you time, money, and energy, you can split the yields and move ahead with the rest of your plans. If you have any queries regarding the same you can call us at 718-977-5462 or visit us at Elite Properties we will provide you the best possible solution in your rough time.

Selling an inherited property can always be the safest option rather than preserving or moving into it. Inherited property is a beautiful gift that is passed on to you, but with the very same gift comes a burden as well. In such a situation selling the inherited property is the smartest move. If you have never sold a home before, you are certainly going to face challenges during the inherited home selling process. As difficult as it is we will provide you with a full-fledged mode of ‘How to find the value of your inherited property that will help with the process to sell your house fast.

Calculating Cost- Basis of an Inherited Property

The cost-basis calculations of an inherited property vary from other mandatory taxes. The cost-basis calculation is based on the Fair Market Value of the property at the time of the homeowner’s death. It can also be calculated when the homeowner transfers the assets to the descendant.

In case, if the worth of an asset or property drops during or post-death, you can choose a valuation date. The valuation date is six months after the death of the owner. By choosing a valuation date you can help reduce the outstanding taxes on the inheritance.

Note: There are no federal taxes levied on inherited property in some states. Although, few of them still clasp a tradition of levying duties as per the relationship with the person who died.

For example, The spouse of the person who died is not liable to pay inheritance taxes. Whereas, a descendant often pays the duties.

Get the House Inspected and Appraised

It is very important to get the actual value of the inherited property. Getting a home inspection and an appraisal serves to get the actual worth of your property. Before you price your home make sure you hire an evaluator who holds experience with inherited property. There are multiple factors that derive the appraised value of your inherited house. The price of the property is appraised on the grounds of the condition, required improvements, and current market value.

Price Suitably To Sell Your House Fast

People often forget pricing your inherited property high may never lead them to the desired sale profit. We know an inherited property has many memories attached to it although, it is crucial to move on with it. Don’t let the memories decide the price of your house. Weigh your needs and act accordingly, if you are in a rush propose a lowballed offer and get away with the pain of maintaining the property.

You can utilize many online tools to carry out a Comparative Market Analysis (CMA) and get an accurate price by comparing comps. Keep in mind hiring a real estate agent will not come in handy. Selling your home through an agent will take days and months including the agent’s fees and property taxes.

Add “Repair Discount” To the Offer

An inherited property requires endless repairs. You need a big chunk of a separate amount other than extra costs and taxes to pay. As the property is to transfer under your name, you become liable for all the repairs you conduct. You can choose to do the required improvements solely if you have enough time and dollars to spend. You can also choose to give a ‘repair discount’. By giving a repair discount you are eliminating the hassle of performing the repairs yourself, which eventually saves you a lot of time and money. Repair discounts entice buyers as the figure of the property is deduced by some amount.

Capital Gains On Selling Inherited Property

If you have made up your mind to sell your inherited property, you cannot free yourself from the tax obligations. When you sell an inherited property the cost – basis is the date of death or the alternate date (valuation period). If you opt to sell an inherited house fast, your capital gains will be minimal. Although, if you hold onto inherited assets for less than a year you have to give tax as same as it would cost for a year.

For example: If the cost basis of your inherited property is 3 million dollars and the price for which you sold your property is 3.1 million dollars, you are only liable to pay capital gains for the extra one million dollars.

Inheritance Tax Exemptions

Inheritance taxes vary from state to state. The exemptions from inheritance taxes depend on the relationship with the person who died. Generally, the surviving spouse is exempt from the inheritance tax. The closer the relationship with the deceased the lower the taxes levied.

Similarly, the inheritance tax threshold varies from state to the relationship with the decedent. The threshold amount varies from 500 dollars to 40 thousand dollars, the tax rate ranges from 1% to 18%. Usually, a state might charge a 13% tax on your inheritances.

Sell Your House Fast For Cash

If you want to sell your inherited property fast, contact cash buying companies like ‘Elite Properties’. The company will buy your home as-is in any condition, which means getting away from the hassle of legal processes. Opting for these companies will save you an ample amount of time and money furthermore, they propose an all-cash offer.

When you are proposed with ‘inherited property for fast cash offer’ and have multiple beneficiaries, it is easy to split the yields of the sale. If you are thinking to sell your inherited house fast, we will buy it for quick cash. Get in touch with ‘Elite Properties’ and get ready for a stress-free home selling process.

A divorce is a very stressful situation, not just for the couple who are separating but also for the rest of the family. It includes several decisions that can put many lives at stake. Similarly, the case is much more complex when property and money are involved.

We are here to help you in this crucial time and guide you through the topic; understanding how to sell a house fast during a divorce, where you would want to make firm decision-making moves and remain stress-free in the coming time of your life.

1. Establishing Ownership

Establishing ownership is done for determining the possibility of how the couple can sell a home. Ownership of a home means; where either of the parties has lived for a substantial amount of at least two years for tax concerns, which is usually pre-defined by the state. In some states the law says; that if a person purchases a property in their own name then, in that case, that particular person is the sole owner of that property. Meaning, that if the person decides to sell the property he or she will be entitled to the proceeds.

While in most states the people obey the common law standards which state; that if the non-owning partner resides in the home for some years and contributes partially for the appreciation of the property such as paying installments or settling the mortgage by some amount, then that person or the spouse would keep a major financial interest through the profits that would be achieved post-sale.

2. Splitting Assets And Capital Gains Taxes

The division of profits after the home is sold relies on aspects like mortgage debts and other liens like outstanding property taxes including the additional terms of the divorce. There can be moderate alterations while a divorce is to finalize, the reason being either of the spouses would have invested a large amount of time or money respectively.

Capital gain taxes means; that if you have held on to an asset for more than a year then you are liable to pay the duty on them which is also known as tax paid on capital gains. If the married couple has filed jointly, they may exclude around 500,000 dollars of the proceeds from their tax liability.

Post the divorce process is complete the tax exclusion has dependencies on each spouse’s qualification for the exclusion. If one spouse can meet the requirements then he or she may exclude up to half the amount which is 250,000 dollars. Whereas, the other one would only be able to claim a partial portion of the amount.

3. When To Sell A House?

• Selling House Before Divorce

Selling the property before the divorce has its own benefits which associate with liquid assets and tax liabilities. If the couple has been living for more than two years on the property, then it has no apprehensions. Either of the spouses will miss satiating the requirements for a full exclusion of 250,000 dollars per person for capital gains. Furthermore, the profit from the home sale will be spilt. This would provide funds to pay outstanding debts and start a new life.

• Selling House During Divorce

Selling your house during a divorce is very strenuous, as divorce in itself is an expensive process. There is a lot that goes into a divorce. It includes paying lawyer’s fees, splitting assets, and piles of other expenses that occur over time. While selling your house during divorce is expensive, it can provide moderate protection for both parties. It can aid in funding long divorce processes when there has been great negotiation involved to settle down the deal. You can also sell your house to companies that buy houses for cash during divorce and sell Your House within 3 Days. You’ll get cash in return for your property which helps both partners in their new beginnings.

• Selling House After Divorce

Couples who have children look for an ideal time to sell the house. In some cases, the person residing in the house post the divorce is finalized. They will buy the other partner’s interest in the home for an unsoiled sale. Whereas, other couples may decide to pay the mortgage installments to meet child support obligations and alimony.

If the above-mentioned process prolongs for more than three years before the sale is complete then the spouse who is no longer living in the house is liable to get the larger share of capital gains taxes post-sale.

4. Consider A Short Sale

If you have remaining outstanding debts left, you’ll have to decide mutually who is going to pay the remaining amount. If nobody agrees to pay, then considering a short sale might be the smartest option for you. It will help in accelerating the daunting home selling process. With the help of Elite Properties, you stay stress-free as we take care of all the legal processes required for a short sale.

A short sale is an agreement with your lender. It states that the house can be sold for less than your mortgage amount. Opting for a short sale is much preferable to having a foreclosure. A foreclosure might ruin your credit score for seven years, while in a short sale you’ll be tagged as clear.

5. List Your House For Sale

If you wish to sell your house while having a divorce then you should consider listing your house for sale. You can get in touch with a real estate agent. He will provide you with the best estimate of your property or you can hire a professional appraiser too.

It is to advise you to do the required upkeep of your house in advance. And perform minor improvements as it will help in surging the cost of your home. Factors such as the condition of the property as a whole, size of bedrooms, carpet area, neighborhood, improvements that are required, etc. will decide the final appraised price of the property. A real estate agent will also think through the recent sales and comps in your locality to cross-verify.

Although, it is a time taking process. And if you think of working at a faster pace this isn’t a suitable option for you.

6. Sell Your House Fast For Cash

Multiple options have been given, which could apparently be time taking and energy-consuming. Divorce is a situation where you are drained emotionally. In such times, you may be searching for companies that buy houses fast. This will help you get away with the never-ending home selling process. ‘Elite Properties’ is a ‘we buy houses for cash company’ in New York that buys your house in any condition and proposes you a no-obligation cash offer. You can sell your house within 3 days without the hassles of the legal process and expedite the home selling process. This will help you save a lot of time, energy, and definitely money as well.

The Bottom Line

In the blog, we showed you a complete scenario and made you understand the possibilities of selling your house fast while going through a divorce. Besides, If you have any other real estate-related concerns you can get in touch with ‘Elite Properties’ they will help you with all your distresses and provide the best possible real estate-associated solutions each time.

When do you realize that you are stuck in a situation where you want to sell your house fast but don’t want to wait for the prolonged home selling process? Here is when “we buy houses for cash” companies come into play. This sign on the hoarding can be very pleasing to your eyes while you are finding ways to sell your house fast.

So here we are explaining the topic we buy houses for cash – how does the process work? As the name says it all we will be enlightening you about the depths of the topic. You can likewise choose your options wisely in the coming time for selling your home.

Types of Homeowners That Approach “We Buy Houses for Cash” Companies

There could be endless reasons that a homeowner would sell its property to a We Buy Houses Cash Company. A possible reason could be an unexpected death of an elderly person. Instead of inheriting the property and waiting for to process to complete. They would sell it to companies that buy houses fast. Another reason might be a couple settling in another state after marriage.

One more reason apart from dodging to inherit a home is that nobody likes to implement improvements that cost dollars. The reason is, only to get the house back in a proper working condition with essential amenities to suffice.

We have put forth the potential categories of homeowners who approach these companies and sell house for cash. You can sell a home without being trapped in the hassles of paperwork and legal processes.

Given below are the types of homeowners and their reasons for why they approach these companies –

- Sellers whose homes are stagnant on the market.

- Couples who have filed a divorce and would be separating.

- Homeowners facing bankruptcy.

- Sellers with homes in probate or foreclosure.

- Homeowners who are relocating for jobs.

- Homeowners who are evicting tenants.

- Unoccupied homes.

It is not necessary that the people mentioned above would be selling their homes for cash for the specified reasons. For example; there could be a possibility that the people selling the houses are additional assets amongst the possessions they own. Another possibility is the homeowner doesn’t want to safeguard the property but, requires hard cash for houses to gain financial stability. Sometimes selling a property is just for mere convenience and shedding that extra baggage of responsibility off their shoulders.

How Does We Buy Houses For Cash Work?

The process of selling a house for cash has several steps. The details for the process of selling a house for cash is given below.

1. Fill Out The Property Details Form

Buyers who buy such properties look for distressed homeowners who would be interested in selling their house below the market price in exchange for a hassle-free, all-cash transaction that involves zero legal processes. The process is extremely simple, you just have to fill up a form and fix a meeting with the potential buyer, rest they’ll take over.

2. Home Evaluation Process

Once the form is filled and reviewed, they will call you for verification and confirmation. They’ll ask if you are a hundred percent sure to sell your property. Further, they will plan a meeting to evaluate the condition of your property. They’ll also fix a price prior to proposing the final offer to you.

3. Buyer Proposed, No-Obligation Offer For Cash

After evaluating the condition of the home, the cash buyer will propose a no-obligation cash offer. It would mean you are not obliged to accept their offer. If you are not happy with the proposal, you won’t be liable to pay any commission to the buyer.

Companies that buy houses for cash purchases your house in whatever condition it may be. They buy ugly and damaged properties; nonetheless, it is expected from the seller not to expect a really high price for the property.

4. Final Purchase Of The House

If you agree to sell property for cash then the cash buyer will purchase your home and perform all the legalizations on your behalf. There will be no real estate agents or any kind of commission involved.

If you don’t want to sell your property but, have noticed these signs around in the neighborhood that say buy my house fast, or if you know anyone who wants to sell the property for cash for houses. You can contact companies like ‘Elite Properties’ and they will get in touch with the seller. If the company purchases the property that you introduced, they’ll pay you the commission as the top finder’s fee.

Finding Cash Home Buyers

Finding cash home buyers is an essential step in selling your home directly for cash. There are several ways to find potential buyers in your area.

- One option is to search online for local real estate investors or cash home buyers. Many of these buyers have websites where you can submit information about your property and receive a cash offer for houses.

- Another option is to ask for referrals from friends, family, or neighbors who may have sold their homes for cash in the past. They may be able to recommend reputable cash buyers in your area who they have had positive experiences with.

- Additionally, you can reach out to local real estate investment groups or attend real estate networking events to connect with cash buyers.

Benefits of We Buy Houses Companies For Cash

- One of the main benefit of we buy houses cash companies is the speed of the transaction. Traditional home sales can take months to complete, but we house buy house are often able to close the deal within a week or two. This is especially beneficial if you need to move quickly or want to avoid the stress of a prolonged selling process.

- Another benefit of companies that buy houses quickly is the convenience it offers. By eliminating the need for listing your home and dealing with potential buyers, you can save valuable time and energy. Instead of spending weeks staging your house and hosting open houses, you can receive a fair cash offer, often within days, and close the deal on your own terms.

- Additionally, we buy houses for cash eliminates the need for costly repairs and renovations. We buy houses any condition are willing to purchase homes in any condition, saving you time and money. Whether your home needs extensive repairs or simply some cosmetic touch-ups, you can sell it as-is without having to invest additional funds into the property because we buy ugly houses.

Common Misconceptions About Selling Your Home For Cash

There are some common misconceptions about selling your home for cash that are important to address.

- One misconception is that cash buyers only purchase distressed or run-down properties. While it’s true that cash buyers are often willing to purchase homes in any condition, they also buy properties that are in good condition. Whether your home needs repairs or is move-in ready, there is likely a cash buyer who is interested in purchasing it.

- Another misconception is that selling for cash for houses means accepting a lower offer. While it’s true that cash buyers typically make offers below the market value of the home, this is often offset by the savings in time, repairs, and commissions.

- Additionally, cash buyers value the convenience and speed of the transaction, which can be a significant advantage for homeowners who need to sell quickly.

Tips For Selling Your Home For Cash

If you’re considering selling your home directly for cash, here are some tips to help you navigate the process:

- Research cash home buyers in your area and choose reputable buyers with positive reviews and testimonials.

- Get multiple offers to ensure you’re getting a fair price for your property.

- Be prepared to negotiate. While cash buyers often make fair offers, there may be room for negotiation.

- Understand the terms and conditions of the sale. Make sure you’re clear on the timeline, closing costs, and any other details before proceeding.

- Consult with a real estate attorney to ensure all legal aspects of the sale are handled properly.

The Bottom Line

Now when you know the in-depth process of how “we buy houses for cash companies” work, you could easily sell your house fast for cash and obtain good returns on your ugly property. Furthermore, if you are residing in NYC and want to sell your house fast, then we buy houses for cash is the only option for the people who buy houses for cash. Get in contact with ‘Elite Properties’ and sell your house within 3 days in any condition, any location. The company will pay your legal fees and closing cost. Call them today at 718-977-5462, and keep all your estate crises at bay.

When do you realize that you are stuck in a situation where you want to sell your house fast but don’t want to wait for the prolonged home selling process? Here is when “we buy houses for cash” companies come into play. This sign on the hoarding can be very pleasing to your eyes while you are finding ways to sell your house fast.

So here we are explaining the topic we buy houses for cash – how does the process work? As the name says it all we will be enlightening you about the depths of the topic. You can likewise choose your options wisely in the coming time for selling your home.

Types of Homeowners That Approach “We Buy Houses for Cash” Companies

There could be endless reasons that a homeowner would sell its property to a We Buy Houses Cash Company. A possible reason could be an unexpected death of an elderly person. Instead of inheriting the property and waiting for to process to complete. They would sell it to companies that buy houses fast. Another reason might be a couple settling in another state after marriage.

One more reason apart from dodging to inherit a home is that nobody likes to implement improvements that cost dollars. The reason is, only to get the house back in a proper working condition with essential amenities to suffice.

We have put forth the potential categories of homeowners who approach these companies and sell house for cash. You can sell a home without being trapped in the hassles of paperwork and legal processes.

Given below are the types of homeowners and their reasons for why they approach these companies

- Sellers whose homes are stagnant on the market.

- Couples who have filed a divorce and would be separating.

- Homeowners facing bankruptcy.

- Sellers with homes in probate or foreclosure.

- Homeowners who are relocating for jobs.

- Homeowners who are evicting tenants.

- Unoccupied homes.

It is not necessary that the people mentioned above would be selling their homes for cash for the specified reasons. For example; there could be a possibility that the people selling the houses are additional assets amongst the possessions they own. Another possibility is the homeowner doesn’t want to safeguard the property but, requires hard cash for houses to gain financial stability. Sometimes selling a property is just for mere convenience and shedding that extra baggage of responsibility off their shoulders.

How Does We Buy Houses For Cash Work?

The process of selling a house for cash has several steps. The details for the process of selling a house for cash is given below.

1. Fill Out The Property Details Form

Buyers who buy such properties look for distressed homeowners who would be interested in selling their house below the market price in exchange for a hassle-free, all-cash transaction that involves zero legal processes. The process is extremely simple, you just have to fill up a form and fix a meeting with the potential buyer, rest they’ll take over.

2. Home Evaluation Process

Once the form is filled and reviewed, they will call you for verification and confirmation. They’ll ask if you are a hundred percent sure to sell your property. Further, they will plan a meeting to evaluate the condition of your property. They’ll also fix a price prior to proposing the final offer to you.

3. Buyer Proposed, No-Obligation Offer For Cash

After evaluating the condition of the home, the cash buyer will propose a no-obligation cash offer. It would mean you are not obliged to accept their offer. If you are not happy with the proposal, you won’t be liable to pay any commission to the buyer.

Companies that buy houses for cash purchases your house in whatever condition it may be. They buy not only ugly but also damaged properties; nonetheless, it is expected from the seller not to expect a really high price for the property.

4. Final Purchase Of The House

If you agree to sell property for cash then the cash buyer will purchase your home and perform all the legalizations on your behalf. There will be no real estate agents or any kind of commission involved.

If you don’t want to sell your property but, have noticed these signs around in the neighborhood that say buy my house fast, or if you know anyone who wants to sell the property for cash for houses. You can contact companies like ‘Elite Properties’ also they will get in touch with the seller. If the company purchases the property that you introduced, they’ll pay you the commission as the top finder’s fee.

Finding Cash Home Buyers

Finding cash home buyers is an essential step in selling your home directly for cash. There are several ways to find potential buyers in your area.

- One option is to search online for local real estate investors or cash home buyers. Many of these buyers have websites where you can submit information about your property also receive a cash offer for houses.

- Another option is to ask for referrals from friends, family, or neighbors who may have sold their homes for cash in the past. They may be able to recommend reputable cash buyers in your area who they have had positive experiences with.

- Additionally, you can reach out to local real estate investment groups or attend real estate networking events to connect with cash buyers.

Benefits of We Buy Houses Companies For Cash

- One of the main benefit of we buy houses cash companies is the speed of the transaction. Traditional home sales can take months to complete, but we house buy house are often able to close the deal within a week or two. This is especially beneficial if you need to move quickly or want to avoid the stress of a prolonged selling process.

- Another benefit of companies that buy houses quickly is the convenience it offers. By eliminating the need for listing your home and dealing with potential buyers, you can save valuable time and energy. Instead of spending weeks staging your house and hosting open houses, you can receive a fair cash offer, often within days, and close the deal on your own terms.

- Additionally, we buy houses for cash eliminates the need for costly repairs and renovations. We buy houses any condition are willing to purchase homes in any condition, saving you time and money. Whether your home needs extensive repairs or simply some cosmetic touch-ups, you can sell it as-is without having to invest additional funds into the property because we buy ugly houses.

Common Misconceptions About We Buy Houses For Cash

There are some common misconceptions about selling your home for cash that are important to address.

- One misconception is that cash buyers only purchase distressed or run-down properties. While it’s true that cash buyers are often willing to purchase homes in any condition, they also buy properties that are in good condition. Whether your home needs repairs or is move-in ready, there is likely a cash buyer who is interested in purchasing it.

- Another misconception is that selling for cash for houses means accepting a lower offer. While it’s true that cash buyers typically make offers below the market value of the home, this is often offset by the savings in time, repairs, and commissions.

- Additionally, cash buyers value the convenience and speed of the transaction, which can be a significant advantage for homeowners who need to sell quickly.

Tips For Selling Your Home For Cash

If you’re considering selling your home directly for cash, here are some tips to help you navigate the process:

- Research cash home buyers in your area and choose reputable buyers with positive reviews and testimonials.

- Get multiple offers to ensure you’re getting a fair price for your property.

- Be prepared to negotiate. While cash buyers often make fair offers, there may be room for negotiation.

- Understand the terms and conditions of the sale. Make sure you’re clear on the timeline, closing costs, and any other details before proceeding.

- Consult with a real estate attorney to ensure all legal aspects of the sale are handled properly.

Frequently Asked Questions

1. How much do ‘we buy houses’ companies pay?

These “we buy houses” companies evaluate homes individually, taking into account factors like location, condition, and the local real estate scene. They’re all about quick sales, offering convenience, especially if you’re in a hurry. It’s not only a fast track to selling, but also it’s a good idea to shop around and explore your options before making a decision.

2. Do I need an attorney to sell a house in New York?

Not mandatory, to have an attorney when selling a house.

3. Is it a good idea to pay cash for a house?

The decision to pay cash for a house depends on individual circumstances and financial goals. Paying cash can offer benefits such as avoiding interest payments and securing a quicker transaction. However, it not only reduce liquidity but also limit investment diversification. Consider factors like overall financial health, opportunity cost, and long-term goals before deciding.

4. Is Home Investors a legitimate company?

Yes, Home Investors is a legitimate company. It is a real estate investment company that specializes in buying homes for cash, often in distressed or as-is conditions.

5. How to negotiate buying a house with cash?

- Research Market: Understand local property values.

- Pre-Approval: Have proof of funds and a bank letter.

- Act Quickly: Cash transactions close faster.

- Strong Offer: Competitive, fair price.

- Negotiate Terms: Emphasize simplicity, flexibility.

- Professionalism: Present as a serious buyer.

- Due Diligence: Thorough inspections.

- Close Quickly: Coordinate efficiently.

- Flexibility: Open to compromise.

- Positive Attitude: Maintain respect and positivity.

The Bottom Line

Now when you know the in-depth process of how “we buy houses for cash companies” work, you could easily sell your house fast for cash and obtain good returns on your ugly property. Furthermore, if you are residing in NYC and want to sell your house fast, then we buy houses for cash is the only option for the people who buy houses for cash. Get in contact with ‘Elite Properties’ and sell your house within 3 days in any condition, any location. The company will pay your legal fees and closing cost. Call them today at 718-977-5462, and keep all your estate crises at bay.

Nothing is worse than knowing your expired listings, and you did everything possible to keep them on the gushing real estate market. You start interrogating the struggles you took for putting it up on the list. To be practical these situations can occur just for reasons like the price was not reasonable or the condition of your home was bad, it can literally be anything.

Hence we would like to share our thoughts about the topic; what to do next when your house listing has expired?

Reasons to Sell Your House

Before thinking of listing your house on the market again it is really important to assess your problems carefully and then proceed towards any futuristic step. There have to be legitimate reasons for selling your house, which can be endless. Some of them could be maybe the couple is going through a divorce or relocating because of the job.

Here, you have to make sure if you actually want to sell your house and list it on the market or maybe you just need to work on your personal life more and take your home off the market if listed already; checking your motivation and saving energy is really essential for the long run.

Consider Measures That Can Help You Sell Your House Quickly

Considering the measures that can actually help you in the potential listing can be a boon and your expired listings. But what are the measures that will help you relist your house?

1. Condition

If your house has good exteriors and interiors but the plumbing has rusted or the sewage pipe is broken, you have to consider making improvements towards the points that can put you at risk of losing your property from listing.

2. Renovation

The condition of your house is really important if your house has been on the market for a prolonged duration is it advisable to take it off the list and start taking steps towards its renovation? Evaluate the necessary changes required in the property and begin from the top because a good beginning makes a good ending although, we would also like to inform you it will cost a runny pocket.

3. Give A Thought On Buyer’s Objections

If your listing has expired then obviously it has already gone through a lot. Check for the flaws in the property which can be an obstacle in the home selling process. If a buyer has neglected your property but is ready to buy it post improvements you’ll have to consider their feedback and work towards it as nobody likes to lose a potential buyer.

Renewed Appraisal

One significant thing you can think through after your expired listings are getting an all-new appraisal. Real estate or the housing market has been underlined as volatile. There is no prediction if the prices of any property can surge for a profit or plummet for a big loss. The best option for you here is to get a renewed real estate appraisal. It will help in achieving the exact value of your home furthermore, aiding in relisting your property.

Secondly, if you are really motivated to sell your house quickly, you can get in contact with a good real estate agent. He will help you in relisting your home and even getting an appraisal done.

Have a Conversation with Your Agent

First things first plan a meeting with your agent after your expired listings. Have a discussion on what effective steps can be taken further to market your home. He’ll compare your home in the market along with the neighboring properties. This helps to find out potential reasons why it got expired and how can you fix the glitches.

Furthermore, you can also contact other agents if you are not satisfied with your current real estate agent or restructure your marketing strategy. To make your property more convincing to buy, take high-quality interior and exterior images of your house. You can post it on social media platforms or contact online prospects and provide a walkthrough of your property.

Sell Your House Fast For Cash

Last but not least, if you have a question like how to sell my house fast for cash? You can always contemplate selling your home to a cash buyer. It does not mean if your listing is expired no one will buy your home. It means there are countless potential buyers who can propose a cash offer. Besides you can contact companies that buy houses for cash like ‘Elite Properties’. They will buy your house for cash and close the deal in as less as 3 days. We hope these methods will help you with collecting efforts and relisting your property on the market again.